Amazon.com: Rpanle USB for Windows 10 Install Recover Repair Restore Boot USB Flash Drive, 32&64 Bit Systems Home&Professional, Antivirus Protection&Drivers Software, Fix PC, Laptop and Desktop, 16 GB USB - Blue : Electronics

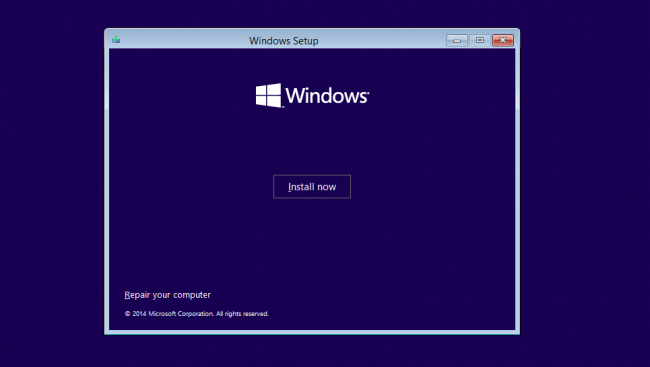

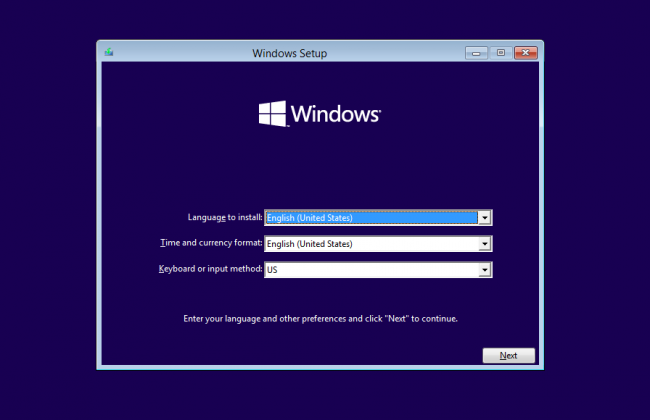

How to clean install Windows 10 and create boot media: Refresh your Windows 10 PC | 2 | Expert Reviews

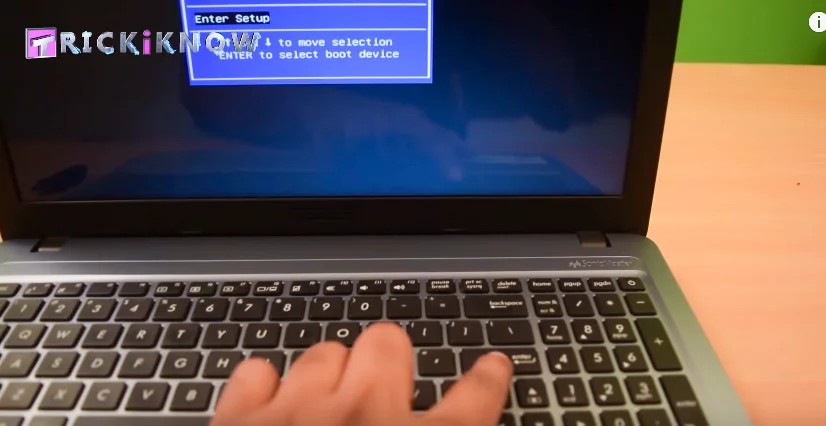

_how-to-install-windows-10-on-hp-notebook-15-from-usb-enable-hp-laptop-boot-option-preview-hqdefault.jpg)

How To Install Windows 10 on HP Notebook 15 from USB (Enable HP Laptop Boot Option) from boot menu key for hp desktop Watch Video - HiFiMov.co

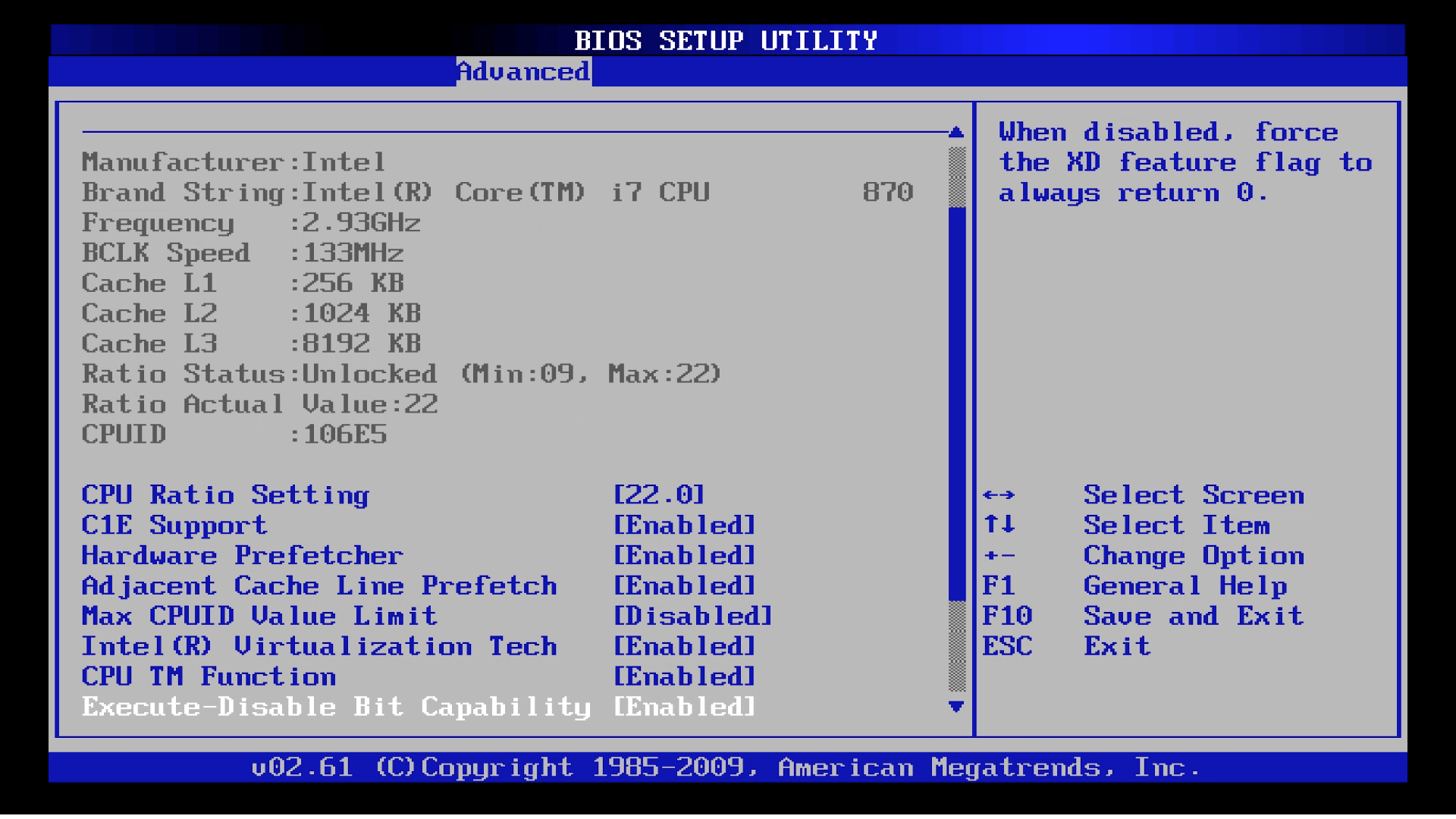

![Windows 11/10] How to create and use installation media to reinstall Windows 11/10 via USB drive | Official Support | ASUS Global Windows 11/10] How to create and use installation media to reinstall Windows 11/10 via USB drive | Official Support | ASUS Global](https://i.ytimg.com/vi/jMW_WHqQBf8/maxresdefault.jpg)