Unterkirnach: Peter Heim – der Hundeflüsterer - Villingen-Schwenningen & Umgebung - Schwarzwälder Bote

Hundeflüsterer - Hundetrainer Saarland, Saarlouis, Reisbach: Hundeschule, Welpenschule, Hundetherapie, Hundespychologie

Hundetrainer Markus Satke - Hundeschule bei München - Hundeschule Satke bei München – Erfolgreich ohne Leckerli

Preise,Hundeausbildung, Hundeerziehung,Hundetraining Nürnberg ,Hundetrainer in der nähe,Problemhundetraining Nürnberg , Welpenschule,Wesenstestvorbereitung,Hundeschule kosten,Hundeschule in der nähe

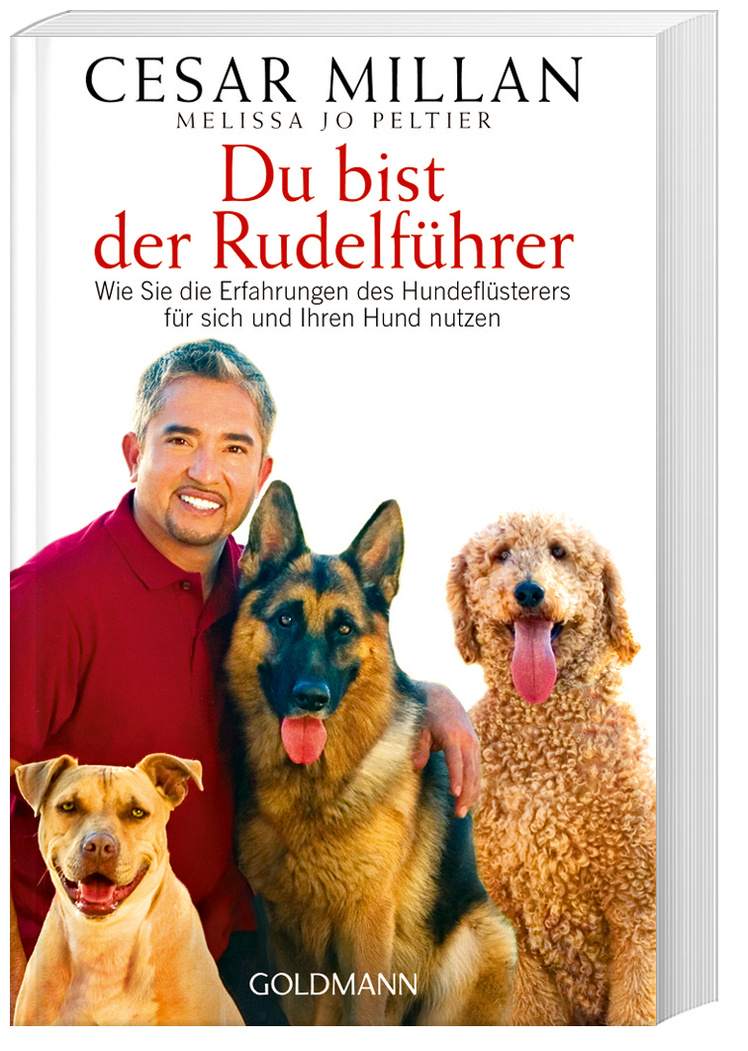

Tipps vom Hundeflüsterer: Einfache Maßnahmen für die gelungene Beziehung zwischen Mensch und Hund (Hörbuch-Download): Cesar Millan, Melissa Jo Peltier, Uwe Thoma, ABP Verlag: Amazon.de: Bücher

Tipps vom Hundeflüsterer: Einfache Maßnahmen für die gelungene Beziehung zwischen Mensch und Hund : Cesar Millan, Melissa Jo Peltier, Andrea Panster: Amazon.de: Bücher