Refoss Smart WLAN Glühbirne E27 unterstützt HomeKit,intelligente alexa lampe Mehrfarbrige dimmbare LED light bulb mit Siri,Alexa,Google Assitant,9W RGBWW 2700K-6500K Warmweiß und Kaltweiß,2 Pack : Amazon.de: Beleuchtung

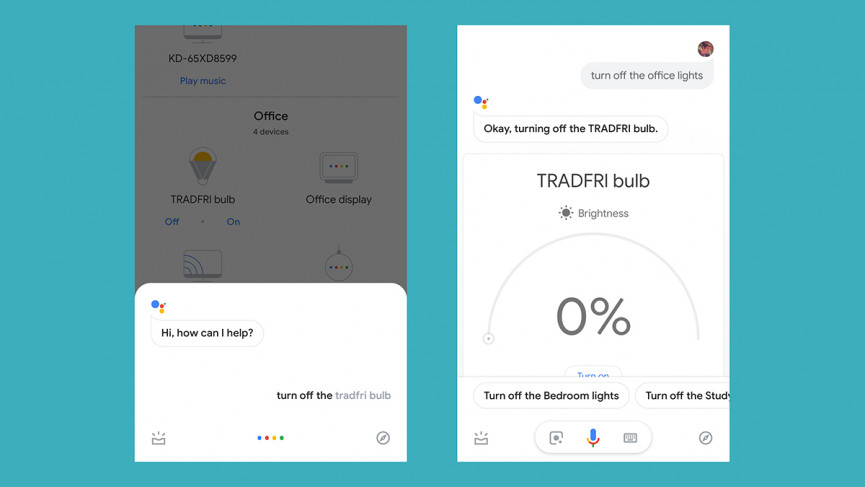

Le lampadine smart di Ikea ora possono essere controllate anche da Google Home e Assistant (foto) | SmartWorld

Le lampadine smart di Ikea ora possono essere controllate anche da Google Home e Assistant (foto) | SmartWorld