East of the Sun and West of the Moon: Old Tales From the North by ASBJORNSEN, Peter Christen; MOE, Jorgen Engebretsen: Very Good Hardcover (1914) First Trade. | Attic Books (ABAC, ILAB)

East of the Sun and West of the Moon by Kay Nielsen: Very Good Hardcover (1914) 1st Edition. | Neverland Books

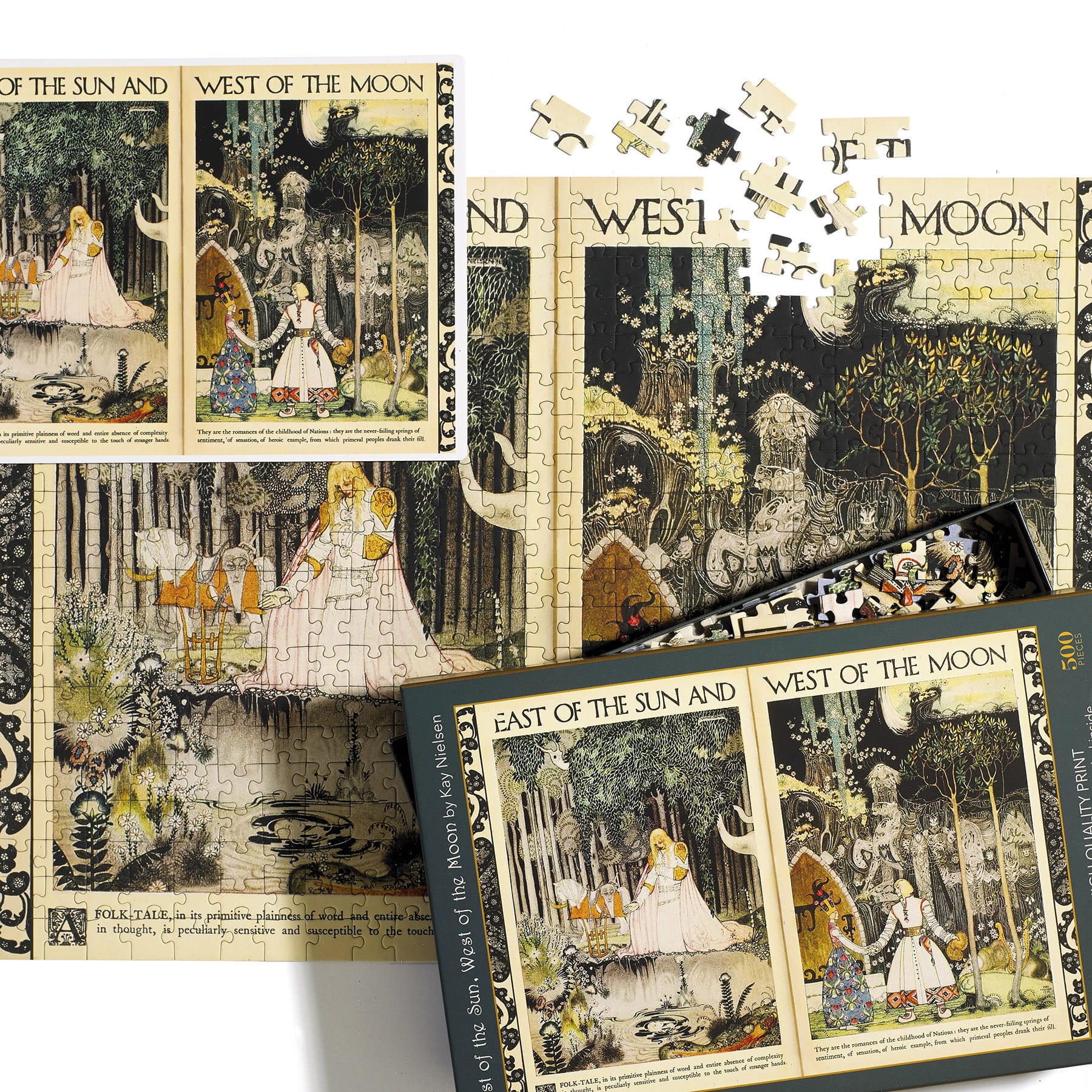

East of the Sun and West of the Moon - Old Tales From the North - Illustrated by Kay Nielsen: Asbjørnsen, Peter Christen, Asbjornsen, Peter Christen: 9781447448983: Amazon.com: Books

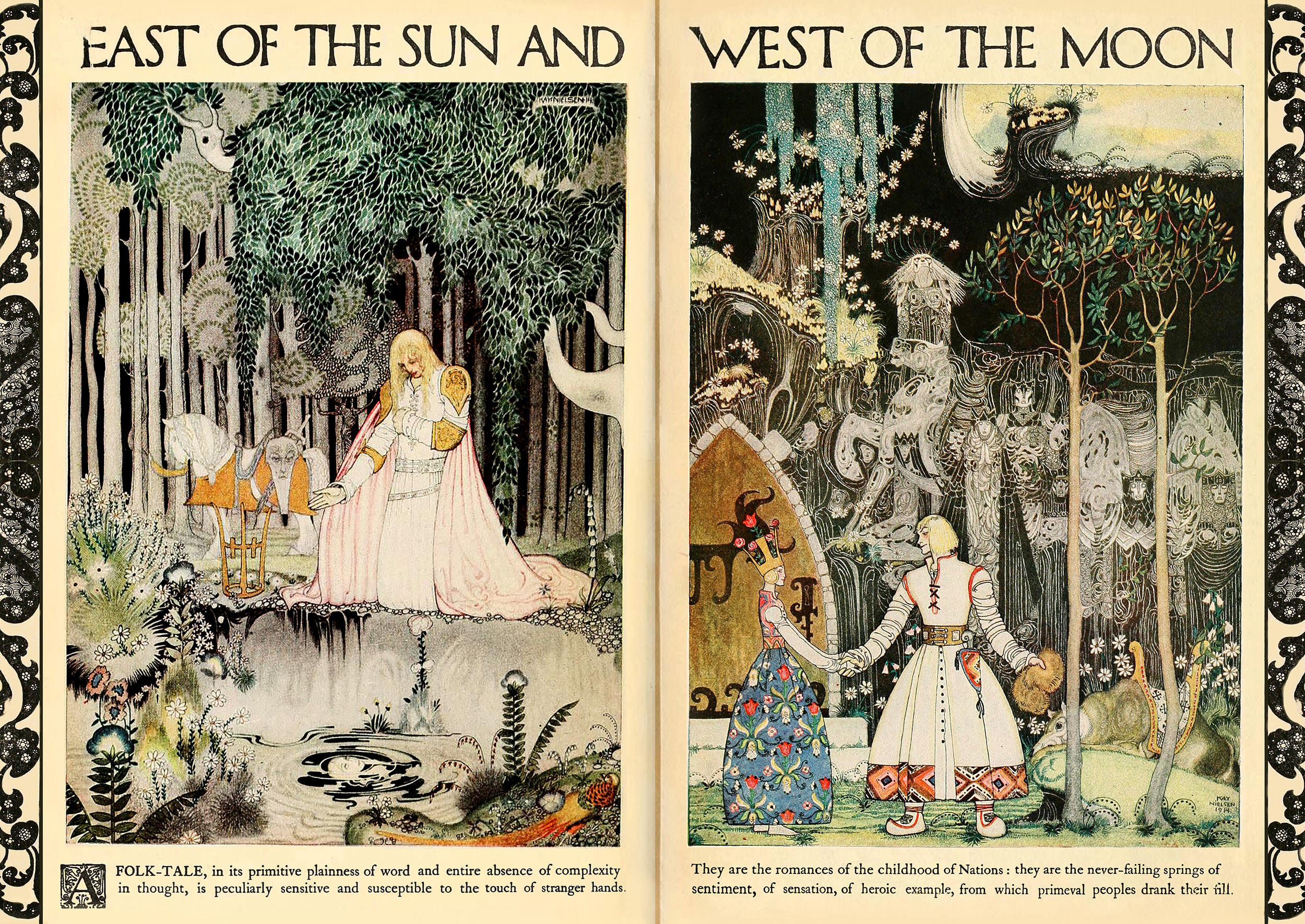

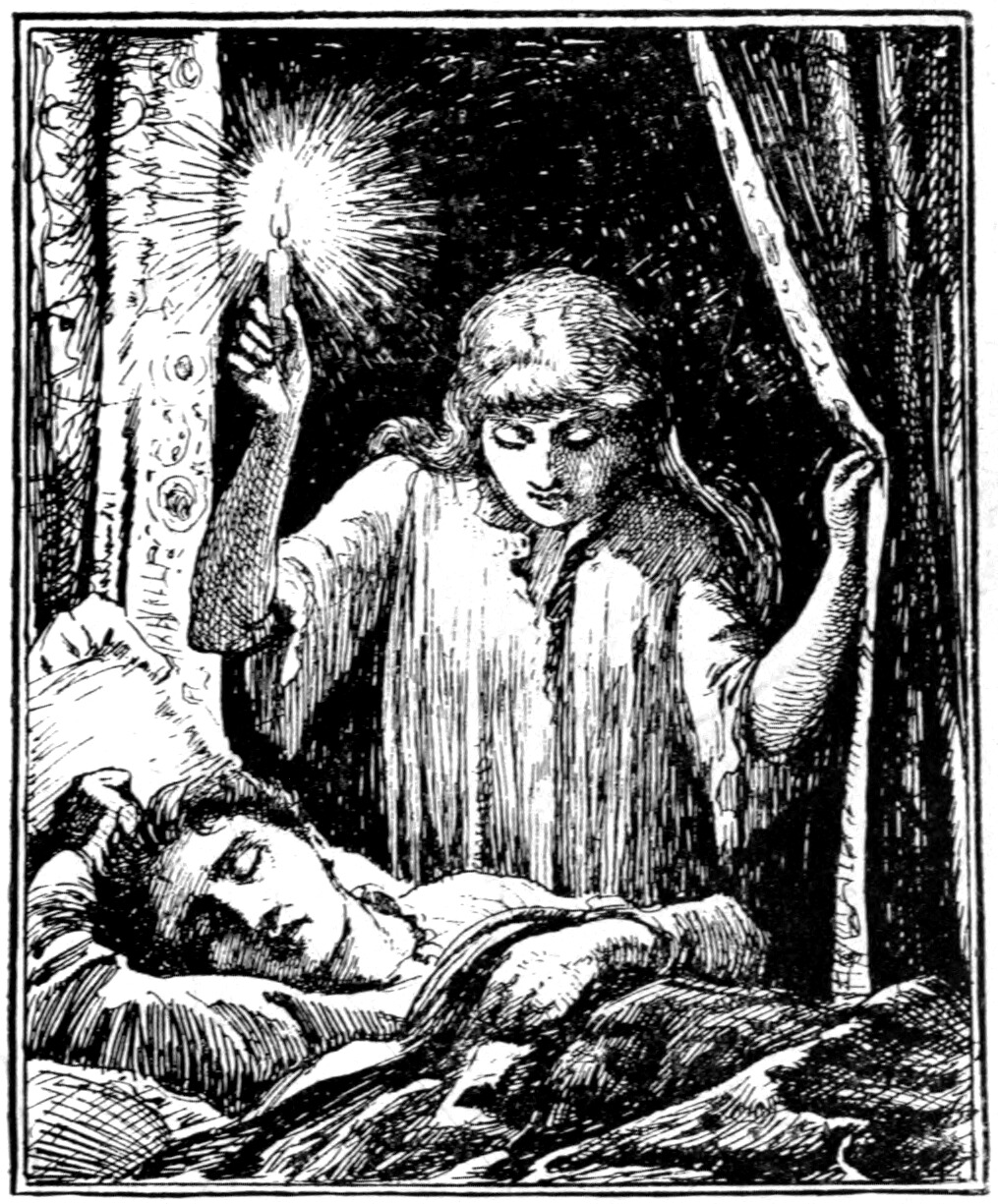

East of the Sun and West of the Moon, illustrated by Kay Nielsen (1922 edition) – The Public Domain Review

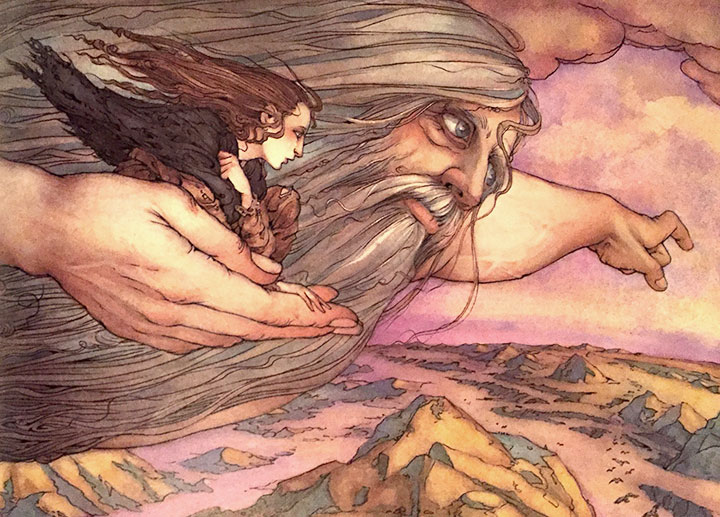

File:Kay Nielsen - East of the sun and west of the moon - soria moria castle - he took a long long farewell of the Princess.jpg - Wikimedia Commons

File:East of the sun and west of the moon - old tales from the North (1922) (14772920093).jpg - Wikimedia Commons